People see ads all the time that say "Bad Credit Accepted" and "Bad Credit is ok" or "Rent to Own Homes available specializing in Bad Credit".......well let's first start off with the most important question.......

What does Bad Credit mean?

The term "Bad Credit" can actually mean many things to many people.......Client #1 us that they have good credit becuase they don't owe any money, Client #2 told us that they had good credit because even though they were 90 days late on payments, they were making them on time! Client #3 told us that they had "Bad Credit" because they missed one $20 payment 3 years ago, and client #4 told us that even though they had 5 Credit Cards all paid on time but they had one $200 Doctor Bill that they had "Bad Credit"

So who is Right?

Well, to a Degree.......all of them are correct. A 750 Credit Score or above means you have "Excellent Credit", a 700 to 749 means you have "Good Credit", a 650 to 699 means you have Fair Credit and anything under a 650 is defined as "Bad Credit" Look at this Chart here!

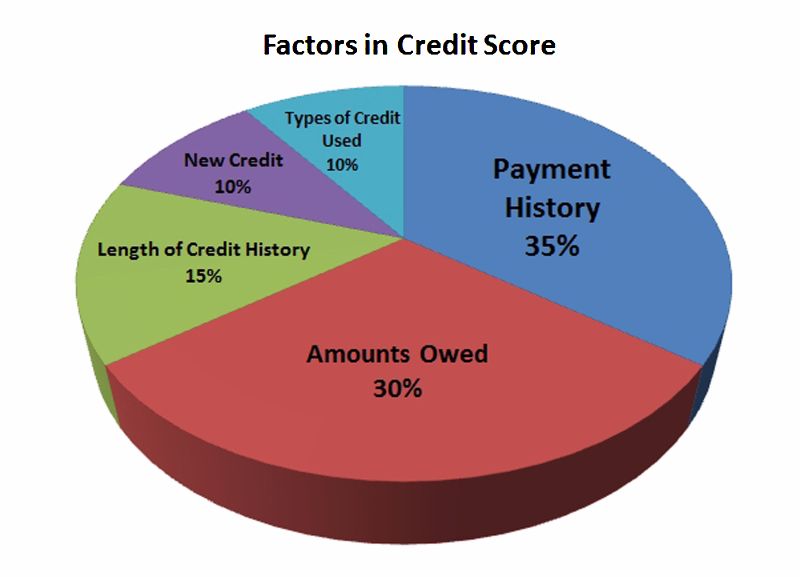

2 of the 4 people in the scenario's above had under a 650 Credit Credit Score.......and it was example's #1 and #2. Client #3 was over 700 and client #4 was was between 650 and 700! 5 things make up your Credit Score.......see the chart below

If you Notice, 35% of your Credit Score is the on time payments of Bills that you VOLUNTARILY took out! You Buy a Car, you pay it on time and 35% of your Score is good! 30% of your Score is the amount of Debt that you have.......so if you have a $500 Credit Card and you pay it off, DON'T CLOSE IT as if you have $500 available to you BUT you owe nothing on it then to a Computer you look disciplined so you will then have 30% of your Score in good standing! 15% of your Scroe is your History so if you have Bad Credit older than 24 months it won't effect your Credit Score nearly as much as if it's within the last 6 month!

So can you Buy a Home with "Bad Credit"? ABSOLUTELY! Here's how:

At the current time, FHA Loans can be obtained with a 580 Credit Score......now you must have COMPENSATING FACTORS so check with a Home Loan Lender to find out the Guidelines about Buying a Home with a 580 Credit Score! And truth be told, you will want to get your Credit Score up above 640 so can Qualify for DOWN PAYMENT ASSISTANCE! You see, you can get a Down Payment Grant to use towards the Down Payment, Closing Costs and Prepaid's from anywhere form $3000 to $15,000 (You need to check with your Local, County, State and Federal Programs in your Area.......your Home Loan Lender will know) that you can use to basically move in for Zero out of pocket! Hence the reason you should try to get your Credit Score up as high as possible! Find out how much Down Payment Assistance you may qualify for by taking our Down Payment Survey!

Now what can you do if you have Bad Credit under a 580 or if you try to buy a Home but you get denied because your Score is above 580 but you don't have those COMSATING FACTORS........well just know that HOPE is not Gone! Let's talk about some options if you have REALLY BAD CREDIT

Option #1 - Call a Credit Repair Company to Legally Dispute all of the negative information on your Credit Report! Did you know if you have Bad Credit, there is a 300% Chance that you have one Bad tem reporting Badly to your Credit Report MULTIPLE TIMES........we often find that the worse your Credit, the more things have been reported MULTIPLE TIMES! WE highly recommend Lexington Law at xxx-xxx-xxxx and they will give you a FREE CREDIT EVALUATION! You can also check out other Credit Repair Companies HERE as well

Option #2 - Start with a Rent to Own Home! You can join a Rent to Own Program HERE that allows you to find a Home, then work on fixing your Bad Credit to Buy that Home at some point in the future.......Again, Rent to Own means that you will Rent a Home for a Predetermined amount of time, then you need to qualify for a Loan to Buy that Home at some predetermined date in the Future! Again, you WILL HAVE TO QUALIFY FOR A HOME LOAN at some point........so just know this in Advance!

Option #3 - Join The Home Blitz Program! The Home Blitz Program allows (AKA The Blitz Program) has 3 steps to it and can help you get Credit Ready very quickly

Step 1 - Help you dispute and remove Bad Credit items

Step 2 - Help you add new, good Credit like The Sub Prime Credit Store, The E Commerce Card & The Beverly Tails Pet Store! These New forms of Credit will help effect your Credit Score up to 80% of the above Credit Score factors (35% on time payments, 30% Debt Load and 15% New History reporting)

Step 3 - Find you Down Payment Assistance, a Local Lender and Local Real Estate Agent as soon as you are Credit Ready!

If you have Bad Credit and you want to join The Blitz Program, you can do it HERE, If you want to know how long it may take you to get Credit Ready, see below

Below is an estimate of how long it will take you to become Credit Ready to Buy a Home with The Blitz Program!

640+= NOW

600-639= 1-3 MONTHS

550-599= 4-6 MONTHS

500-549= 7-12 MONTHS

500 AND BELOW= 12 MONTHS

You can Join The BLITZ Program HERE and talk to a Specialst today!

Do you know what your current Credit Score even is? EVERYTHING starts with your CURRENT CREDIT SCORE! And we say CURRENT as your Credit Score changes Daily! So if you checked out your Credit Score 3 months ago.....it has most likely CHANGED.......

GET YOUR CURRENT CREDIT SCORE HERE

Leave a Comment, Ask a Question, or Leave a Review